Cork Views: Childless citizens need a fairer deal on tax

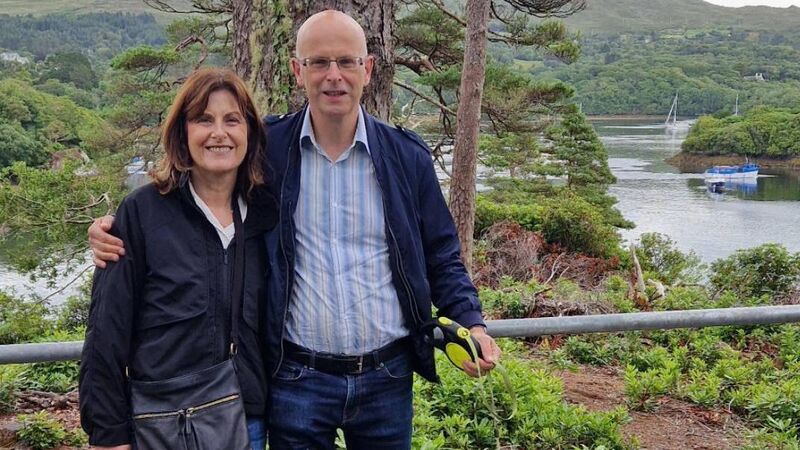

James and Sheila Sexton are part of a campaign group called EDIT (End Discrimination in Inheritance Tax for Childless Citizens).

We met and married a little later in life - in our 40s. We do not have children of our own, but we do have a family of loved ones who are an important part of our lives.

When we got married, we both made our wills, and it was only then that we discovered that the current Inheritance Tax legislation treats parents very differently to that of childless adults.

As childless citizens, we are not allowed to pass tax-free the same value of our fully taxed assets to our loved ones as that afforded to parents.

Parents can pass assets up to €400,000 tax-free to each of their children. Sheila and I are only permitted to pass assets up to €40,000 tax-free to each of our loved ones.

This is both inequitable and discriminatory.

We are not advocating for anything to be taken away from parents and their children. Instead, we are simply advocating for equality and an end to the discrimination faced by all childless citizens.

When this debate comes up, there is a common misconception that Inheritance Taxes are something that only concerns the wealthy.

This could not be further from the truth - any couple or single person who does not have children and whose only asset perhaps is the home that they have worked so hard for during their lifetime will be severely affected.

Sheila and I have always worked hard - I’m a teacher and Sheila is an accountant - and we believe that we should have the same control over our fully taxed assets as parents.

Unfortunately, so many couples and single people without children are not even aware of this inequality.

Sadly, it is only upon their passing that their loved ones will realise how unfairly they are being treated by the State - with a very significant inheritance tax bill to pay.

Of course, it is up to the government to decide what the inheritance tax threshold levels should be and what % rate of tax should be applied.

However, the same rules should apply to all citizens - single people or couples without children should receive the same tax treatment as parents. This is not the case currently and this is discriminatory.

This discrimination applies to more than one million childless citizens. Ireland has the third highest rate of childlessness in the developed world.

Consider a family with three children. This family can pass assets up to €1,200,000 tax-free to their three children.

In contrast, a childless citizen can only pass assets up to €120,000 tax-free to three of their loved ones - ten times less!

This is clearly discriminatory and grossly inequitable.

For all childless citizens who die with assets worth more than €40,000, their loved ones are faced with financial ramifications that simply do not apply to most parents and their children.

The Equal Status Acts 2000-2018 are enshrined in law and are supposed to exist to provide protection for all citizens.

Can you imagine if the State allowed our Inheritance Tax legislation to discriminate against citizens with disabilities? And yet, our Inheritance Tax legislation currently discriminates against all citizens without children.

This cannot be allowed to continue.

We believe a person’s principal private residence (their home) should be exempt from inheritance tax. This would be hugely popular with those who turn out to vote in elections.

There is perhaps a case to be made that for those with substantial savings, multiples houses or holiday homes, they could reasonably be expected to contribute more.

It must be remembered that Inheritance Tax is a death tax levied on assets and savings belonging to a tax-compliant deceased person. Is it state-approved theft or ‘graveside robbery’?

Citizens without children can no longer be used as an easy scapegoat to raise tax revenue.

The burden of Inheritance Tax must be shared equally and fairly between all citizens and their loved ones - those with and without children.

The current yield from Inheritance Tax is less than 1% of the total tax intake to the State, but the negative impact on ordinary citizens is enormous. We are members of a campaign group called EDIT (End Discrimination in Inheritance Tax for Childless Citizens).

Over the last year, EDIT has lobbied the Taoiseach, the Minister for Finance, the Tánaiste, the Minister for Equality, and the Minister for Public Expenditure to demand complete reform of the current Inheritance Tax legislation.

We would urge all childless citizens and parents to send a short email or to make a quick phone call to all their local TDs to express their concerns about the inequality and discrimination in the current Inheritance Tax legislation.

They are all now fully aware of this issue and they are certainly listening.

Make that call today, and have your voice heard.

App?

App?