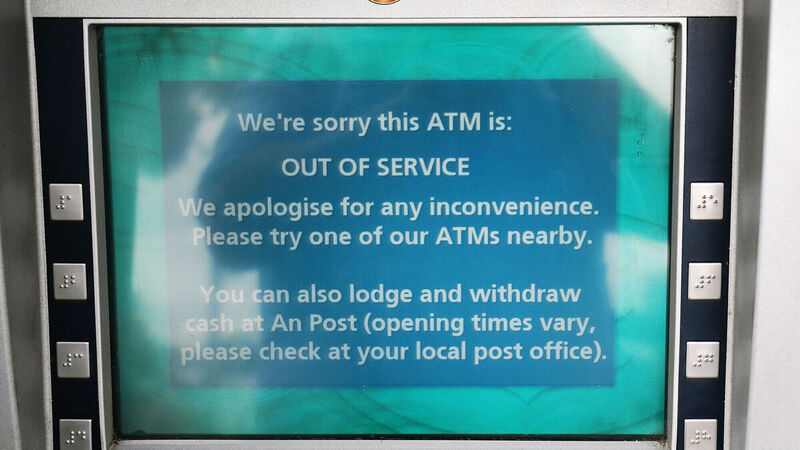

Billy Kelleher: Customers are ‘taken for granted by banks’

Elected representatives have also drawn attention to “massive” profits being made by Bank of Ireland – more than one billion euro in the first half of this year – and called for greater reinvestment in its IT systems. Pic: Brian Lawless/PA Wire

App?

App?